The Single Strategy To Use For Financial Advisor Jobs

Wiki Article

The Single Strategy To Use For Financial Advisor Jobs

Table of ContentsEverything about Financial Advisor Job DescriptionAll About Advisors Financial Asheboro NcOur Financial Advisor Meaning StatementsIndicators on Financial Advisor Definition You Should KnowThe 6-Second Trick For Financial Advisor Job Description

/financial-advisor-career-information-526017_v3-01-8def22beb8744989ab21839da3229c01.png)

You need to also think about exactly how much money you have. If you're trying to find a consultant to manage your money or to assist you invest, you will require to fulfill the expert's minimal account needs. Minimums differ from consultant to consultant. Some may collaborate with you if you have just a few thousand dollars or less.

You'll after that have the capability to interview your suits to discover the appropriate fit for you.

The 10-Second Trick For Financial Advisor Jobs

Before meeting with an advisor, it's an excellent suggestion to believe regarding what kind of consultant you need. If you're looking for particular suggestions or services, consider what type of economic expert is a professional in that area.

Which one should you deal with? We locate that, mostly, individuals looking for economic suggestions know to try to find a financial advisor that has high degrees of stability and also who desires to do what is in their clients' ideal passion whatsoever times. It seems that fewer individuals pay interest to the positioning of their economic advisor prospects.

Unknown Facts About Financial Advisor Fees

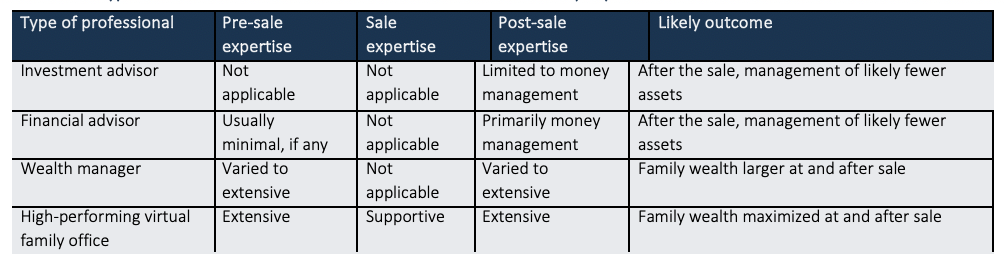

Here's a take a look at 4 different sorts of experts you are likely to come across as well as exactly how they pile up against each various other in some essential areas. Armed with this details, you should have the ability to much better assess which type is finest matched for you based upon elements such as your goals, the intricacy of your economic situation and also your internet well worth.Let's check out each team. 1. Investment advisor. An excellent method to consider the wide range monitoring power structure is that it's dynamic, or additive. We begin with the base. Financial investment experts are excellent financial professionals that do a great job managing moneybut that's all go right here they do. While investment advisors give a single solutionmoney managementthat one remedy can have numerous variants (from safeties to financial investments in personal business, real estate, art work and so forth).

, one have to initially acquire the needed education and learning by taking monetary advisor training courses. Financial experts should have at the very least a bachelor's degree, and also in some cases a master's is suggested.

10 Simple Techniques For Financial Advisor Certifications

Financial advisors will certainly need this structure when they are recommending clients on decreasing their risks as well as saving money. An additional area of study focuses on financial investment preparation. In this training course, students learn just how the supply market jobs together with other investment strategies. When functioning as an economic expert, expertise of investment planning may show crucial when attempting to develop investment strategies for customers., such as transforming a headlight or an air filter, however take the vehicle to an auto mechanic for large jobs. When it comes to your funds, however, it can be harder to figure out which work are DIY (advisor financial services).

There are all kinds of monetary pros around, with dozens of different titles accounting professionals, financiers, cash supervisors. It's not always clear what they do, or what my explanation type of issues they're geared up to manage. If you're really feeling out of your deepness monetarily, your first action should be to discover who all these different monetary specialists are what they do, what they bill, and what options there are to hiring them.

The 15-Second Trick For Financial Advisor

1. Accounting professional The primary factor many people employ an accounting professional is to help them financial advisor database prepare and file their income tax return. An accountant can assist you: Fill in your income tax return correctly to stay clear of an audit, Locate deductions you may be missing out on out on, such as a home office or childcare reductionSubmit an extension on your taxes, Invest or give away to charities in methods that will certainly reduce your tax obligations later If you own a business or are starting a side service, an accounting professional can do various other jobs for you.

Your accounting professional can additionally prepare financial statements or records. Just How Much They Price According to the National Culture of Accountants, the average cost to have an accountant file your tax obligations varies from $159 for an easy return to $447 for one that consists of organization revenue. If you want to hire an accounting professional for your business, the rate you pay will rely on the dimension of the company you're dealing with and the accountant's level of experience.

Report this wiki page